Arbitrum Price Prediction 2023 – 2032

- Arbitrum Price Prediction 2023 – up to $1.71

- Arbitrum Price Prediction 2026 – up to $5.21

- Arbitrum Price Prediction 2029 – up to $15.53

- Arbitrum Price Prediction 2032 – up to $50.46

As the powerhouse behind a booming decentralized finance (DeFi) ecosystem, Ethereum has undeniably carved out a prominent position in the world of blockchain and cryptocurrencies. But while the network boasts of its decentralized nature, reliability, and user-friendly smart contract support, it struggles with the challenges of scalability and soaring transaction fees. How about Arbitrum price prediction?

Let’s listen in as they compare ARB and LQTY. https://twitter.com/arbitrum/status/1653813896396824576?s=20

As the world anticipates improvements, a third alternative has emerged: scaling solutions. These innovative software applications operate on top of a blockchain’s base layer, such as Ethereum, to enhance its performance. Arbitrum is a prime example of a scaling solution that has gained popularity recently among Ethereum users for executing their transactions more efficiently.

Arbitrum could indeed add to Ethereum’s numerous advantages, boost the network’s sluggish performance, and reduce its skyrocketing fees that threaten to hinder its growth and dissuade potential users. Ethereum users must weigh their options: jump ship to faster, more cost-effective blockchains like Solana, Fantom, or Avalanche, or hold out for the much-anticipated upgrades set to revitalize the network in the coming years. Or consider Arbitrum.

How much is Arbitrum Worth?

The current price of Arbitrum is $1.171266. Over the past 24 hours, it has seen a trading volume of $490.32 million. With a market capitalization of $1.49 billion, Arbitrum holds a market dominance of 0.13%. However, the ARB price has experienced a decrease of 4.50% in the last 24 hours.

ARB price analysis: ARB price makes a bearish breakout at $1.2

TL; DR Breakdown

- ARB price analysis shows bearish domination with a breakout at $1.2

- Resistance for ARB is present at $1.25

- Support for ARB/USD is present at $1.12

The ARB price analysis for 5 June confirms an intense bearish rally, suggesting selling momentum from the bears near $1.2. As bears faced support above $1.15, the price surged above its 23.6% Fib level, creating a bearish zone near the $1.2 level.

ARB price analysis 1-day chart: ARB/USD drops heavily below the EMA20

Analyzing the daily price chart of Arbitrum, ARB’s price has witnessed a massive decline from its critical level of $1.2. However, after making a low at $1.15, ARB witnessed a minor buying pressure, initiating an upward correction in the price chart. The 24-hour volume has made a decline today as it touched $808.42K, showing a fall in confidence in trading activities. ARB price is currently trading at $1.17, decreasing nearly 4.5% in the last 24 hours.

The RSI-14 trend holds its momentum near the midline as it hovers at the 46.94-level, hinting that bullish sentiment is surging following a recovery below EMA20. The SMA-14 level suggests upward volatility in the next few hours.

ARB/USD 4-hour price chart: ARB price continues to break below EMA lines

The 4-hour ARB price chart suggests that bears are currently putting selling pressure near $1.17 to prevent the price from surging above $1.2. However, after making a low at $1.1586, the price now attempts to surge higher.

The BoP indicator is trading in a bearish region at 0.54, bringing the potential of a downward correction for short-term holders and luring traders to open short positions.

The MACD trend line has formed long red candles below the signal line, and the indicator is now attempting to trade below the signal line, further strengthening sellers’ confidence.

What to expect from ARB price analysis next?

The hourly price chart confirms that bears are paving their way to push the price below the immediate support level. However, if ARB’s price successfully holds its momentum above $1.25, it may break out and touch the resistance at $1.37.

If bulls fail to initiate a surge, ARB price may drop below the immediate support line at $1.12, resulting in a downward correction to $1.06.

Arbitrum Price Predictions 2023-2032

Price Predictions By Cryptopolitan

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2023 | 1.46 | 1.51 | 1.71 |

| 2024 | 2.1 | 2.17 | 2.57 |

| 2025 | 3.01 | 3.1 | 3.59 |

| 2026 | 4.18 | 4.33 | 5.21 |

| 2027 | 6.12 | 6.29 | 7.23 |

| 2028 | 9.01 | 9.32 | 10.65 |

| 2029 | 13.57 | 13.94 | 15.53 |

| 2030 | 19.9 | 20.46 | 24.02 |

| 2031 | 28.71 | 29.74 | 34.42 |

| 2032 | 43.29 | 44.48 | 50.46 |

Arbitrum Price Prediction 2023

In 2023, the estimated minimum value of Arbitrum is projected to be $1.46. The price of Arbitrum could potentially reach a peak of $1.71, with an average trading price of $1.51 throughout the year.

Arbitrum Price Prediction 2024

Our in-depth technical analysis of past ARB price data suggests that in 2024, the price of Arbitrum could be around a minimum value of $2.10. The price of Arbitrum could potentially reach a peak of $2.57, with an average trading value of $2.17.

ARB Price Prediction 2025

The price of a single Arbitrum is anticipated to reach a minimum of $3.01 in 2025. The ARB price could potentially reach a peak of $3.59, with an average price of $3.10 throughout the year.

Arbitrum Price Prediction 2026

Our in-depth technical analysis of past ARB price data suggests that in 2026, the price of Arbitrum could reach a minimum of $4.18. The ARB price could potentially reach a peak of $5.21, with an average trading price of $4.33.

Arbitrum Price Prediction 2027

Based on our price forecast and technical analysis, the price of Arbitrum in 2027 could reach a minimum of $6.12. The ARB price could potentially reach a peak of $7.23, with an average trading price of $6.29.

Arbitrum Price Prediction 2028

The price of Arbitrum is projected to reach a minimum of $9.01 in 2028. According to our analysis, the ARB price could potentially reach a peak of $10.65, with an average forecast price of $9.32.

Arbitrum Price Prediction 2029

Based on our forecast and technical analysis, the price of Arbitrum in 2029 could reach a minimum of $13.57. The ARB price could potentially reach a peak of $15.53, with an average price of $13.94.

Arbitrum Price Prediction 2030

The price of Arbitrum is projected to reach a minimum of $19.90 in 2030. According to our analysis, the ARB price could potentially reach a peak of $24.02, with an average forecast price of $20.46.

Arbitrum (ARB) Price Prediction 2031

In 2031, the estimated minimum price of Arbitrum is projected to be $28.71. The price of Arbitrum could potentially reach a peak of $34.42, with an average price of $29.74 throughout the year.

Arbitrum Price Prediction 2032

Arbitrum’s market cap may surge in the next few years and analysts expect the Arbitrum ecosystem to expand exponentially, potentially pushing the ARB token’s price to new highs. In 2032, the estimated minimum value of Arbitrum is projected to be $43.29. The price of Arbitrum could potentially reach a peak of $50.46, with an average trading price of $44.48 throughout the year.

Arbitrum Price Prediction By CoinCodex

Based on Coincodex’s latest Arbitrum price analysis, the projected forecast for Arbitrum indicates a potential decline of -9.45%, with an estimated value of $1.062794 by June 10, 2023. Their technical indicators suggest a Bearish sentiment at the moment, while the Fear & Greed Index stands at 53 (Neutral). Over the past 30 days, Arbitrum has experienced 12/30 (40%) green days, and the price volatility has been recorded at 3.86%. Taking these factors into consideration, Coincodex’s forecast suggests that the current market conditions are unfavorable for purchasing Arbitrum.

Arbitrum Crypto Price Prediction By DigitalCoinPrice

According to DigitalCoinPrice’s Arbitrum price forecast, the price of ARB is anticipated to surpass the $2.53 mark in 2024. By the end of the year, Arbitrum is predicted to attain a minimum value of $2.48. Furthermore, the ARB price has the potential to reach a maximum level of $2.69.

In 2027, the price of ARB may exceed the $22.12 mark. By the end of the year, Arbitrum is predicted to reach a minimum price of $22.03. Furthermore, the ARB price has the potential to gain a maximum level of $22.83.

Arbitrum Price Prediction By CryptoPredictions.com

CryptoPredictions.com’s Arbitrum network price prediction states that Arbitrum is projected to begin July 2023 at a price of $1.621 and conclude the month at $1.589. Throughout July, the highest anticipated ARB price is $1.886, while the lowest expected price is $1.282.

In 2027, the ARB token may hit a minimum price of $2.503 and a maximum price of $3.681, with an average closing price of $2.945.

Arbitrum Price Prediction By Market Sentiment

Arbitrum token (ARB) made its debut on March 23, 2023. Although there are limited technical indicators to predict market trends, its strong fundamentals cannot be ignored, especially with a team of competent experts backing it. Furthermore, the network’s ability to validate transactions at lightning-fast speeds makes it an attractive option for cost-effective and speedy transactions.

However, the current market sentiments are negative due to the controversial proposal. Despite this, the ARB network has achieved notable milestones, and experts are optimistic about its future as they create upside price targets to buy Arbitrum. According to them, ARB tokens may reach a minimum value of $10 by Q2 in 2023.

Arbitrum Overview

Arbitrum technology emerges as a promising answer to the challenges of congestion and soaring fees on the Ethereum network. On March 23, 2023, Arbitrum distributed its new ARB token through an airdrop, empowering token holders to participate in decision-making processes associated with the protocol. By doing so, Arbitrum embarks on its highly anticipated transformation into a DAO (decentralized autonomous organization).

Arbitrum, a cutting-edge layer-2 scaling solution for the Ethereum blockchain, was created by New York-based firm Off-chain Labs. In 2018, Ed Felten, a professor of computer science and public affairs at Princeton, co-founded Offchain Labs, the innovative enterprise responsible for the development of Arbitrum.

Layer-2 scaling solutions are networks that operate on top layer-1 blockchains, delivering cost-effective and swift transactions. By validating transactions independently and later incorporating them into the primary chain, these solutions alleviate congestion on the main blockchain.

Following its mainnet debut last year, Arbitrum’s scaling solution has experienced considerable success. Consequently, numerous developers have leveraged Arbitrum’s technology to host their decentralized applications (dApps).

Arbitrum Bridge

Users can employ the Arbitrum Token Bridge to transfer ETH and ERC-20 Ethereum tokens to a layer 2 scaling solution known as Arbitrum One. To execute a transaction using Arbitrum, simply forward it to one of EthBridge’s Inbox contracts.

Conversely, an Outbox contract receives data from Arbitrum and incorporates it into the Ethereum blockchain for reverse interaction. As all inputs and outputs of EthBridge are publicly verifiable, Ethereum can efficiently identify and authenticate any off-chain actions.

How Does Arbitrum Work?

Individuals and smart contracts submit requests to Arbitrum’s blockchain by placing transactions into the chain’s ‘inbox.’ Subsequently, Arbitrum processes the request and generates a transaction receipt. The method by which Arbitrum processes the transaction – determining its ‘chain state’ – is dictated by the transactions present in its inbox.

Currently, Arbitrum handles Ethereum transactions using a technique known as optimistic rollup. This method settles transactions on a sidechain before reporting the results back to the Ethereum network.

Transactions On Arbitrum

Arbitrum offers a cost-effective and speedy alternative while still relying all transaction data back to the primary Ethereum blockchain. While Ethereum can only handle a modest 14 transactions per second, Arbitrum boasts an impressive 40,000 TPS. Ethereum transactions cost several dollars, whereas Arbitrum transactions cost merely around two cents.

Additionally, Arbitrum is compatible with the Ethereum Virtual Machine (EVM), allowing Ethereum DeFi developers to seamlessly integrate their decentralized applications (dApps) with Arbitrum without needing any modifications.

Arbitrum employs ArbGas to monitor the execution cost on its chain. Each Arbitrum VM instruction carries an ArbGas cost, and the total cost of a computation corresponds to the sum of the ArbGas charges for the instructions involved, as opposed to Ethereum’s gas limit.

This implies that Arbitrum does not impose a rigid ArbGas limit, making it significantly more affordable than Ethereum’s gas fees. The fee is typically levied to reimburse Arbitrum chain validators for their costs, although it is set to zero by default.

Recent News

Circle has recently declared its intention to launch a new native iteration of its USD Coin stablecoin on the Arbitrum network, scheduled for June 8. As stated in a blog post, Circle will substitute the current version of USD Coin, which is an Ethereum-based token that has been linked to Arbitrum, with a native token that operates and is housed directly on the Arbitrum network.

Latest Achievements Of Arbitrum

Following Ethereum’s highly anticipated Shanghai upgrade, Arbitrum’s ARB token has risen to prominence as one of the top-performing digital currencies in the market. ARB network has achieved significant milestones recently following the hype among users.

$2.5 Million Profit In March

In March 2023, Arbitrum reportedly generated profits of $2.5 million through sequencing, as stated by Messari.

It’s important to note that sequencer profits represent the difference between the fee revenue generated by the Layer-2 chain and the fee expense paid to the base Layer-1 chain, all calculated in Ethereum’s Ether token rather than ARB. As ArbitrumDAO evolves into a more decentralized, community-managed organization, these profits will ultimately be directed toward it.

Arbitrum Outperformed Its Rival Optimism

Arbitrum has consistently surpassed its primary Ethereum Layer-2 competitor, Optimism, in nearly all crucial metrics throughout 2022 and 2023.

For example, in 2022, Arbitrum generated $22 million in sequencer revenue and $6 million in profits, while Optimism secured $18 million and $4 million in sequencer revenue and profits, respectively.

Likewise, during the first quarter of 2023, Arbitrum outpaced Optimism by $4 million in revenue and $3 million in profits.

Controversy Regarding AIP-1

A proposal (AIP-1) to allocate 750 million ARB tokens—nearly $1 billion—to the Arbitrum Foundation sparked debate within the ARB community recently. The controversy escalated after the foundation revealed that the vote was intended solely to confirm a predetermined decision.

Following the tumult that arose from its initial unsuccessful governance attempt, the Arbitrum Foundation unveiled a series of new improvement proposals.

On April 5, Ethereum layer-2 solutions provider Arbitrum released fresh Arbitrum Improvement Proposals (AIPs) to govern the network.

These new proposals consist of AIP-1.1, addressing a smart contract lockup schedule, expenditure, budget, and transparency, and AIP-1.2, which amends existing founding documents and reduces the proposal threshold from 5 million to 1 million ARB tokens to enhance governance accessibility.

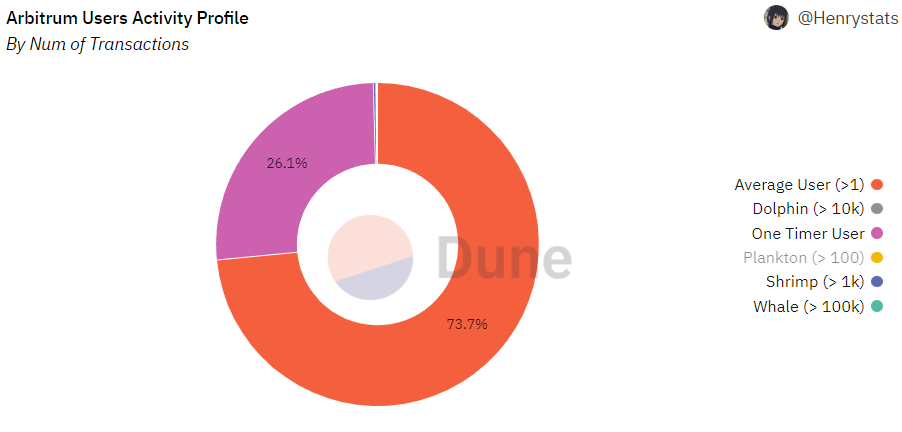

Despite this controversy, On April 17, the total number of wallet addresses for the Ethereum layer-2 scaling solution Arbitrum (ARB) exceeded 5 million. In addition to individual addresses, the ARB ecosystem now boasts over four million active accounts, with close to 200 million transactions executed since its inception.

Conclusion

In the early stages, Ethereum and Bitcoin prioritized decentralization and security, leading to high gas fees on their platforms. Arbitrum, on the other hand, aims to address this issue by incorporating Optimistic Rollups that cater to all three elements of the blockchain trilemma.

Despite this, the Ethereum community believes that the long-term solution lies in the implementation of zk-Rollup. As the most advanced L2 platform, Arbitrum is expected to incorporate the latest technology trends to enhance scalability and facilitate its expansion.